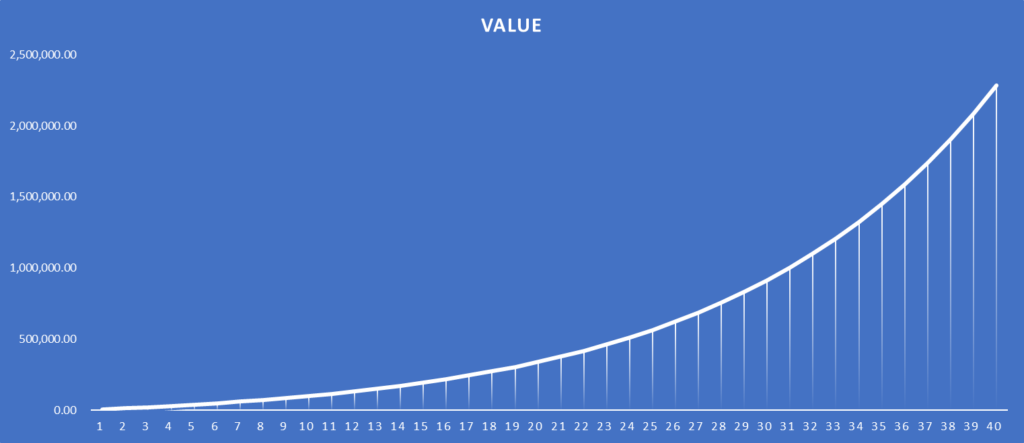

One of the best gifts we ever got from our Canadian government was the Tax-Free Savings Account. (TFSA). But apparently a lot of people aren’t taking full advantage of this opportunity. On September 18th a Globe and Mail article said that 43% of people surveyed believed that it is for savings and not for growing investments. (Canadians should be making better use of TFSAs) Since it’s inception I thought this was the best vehicle to invest in for retirement. If done for 30 – 40 years you can really see the power of compounding. The chart below shows how a maximum allowable amount is invested each year and the dividends re-invested.

This post is not about what is better to use in an individual’s circumstances. It is just to show what is possible if we use a TFSA.

In BC the age that you can open a TFSA is 19. Now not every 19-year-old will have $6,000 to invest, but even if you start a little later, see what happens over 40 years by just maximising this one strategy.

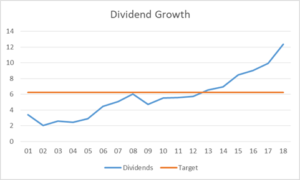

This calculation is based on investing $6,000 in a self-directed account every year and re-investing the dividends. Dividends can be set up to be re-invested automatically when they are paid. My strategy would be to buy one stock each year that pays at least 4% in dividends. (For companies that pay these kinds of dividends see previous posts.) We also assume a 5% average gain each year for these companies. You will also get dividend raises each year of approximately 3%. These numbers are very conservative compared to what we’ve achieved over the last 20 years.

Then, each year as you add another company, your diversifying your portfolio. When investing for the long term, it isn’t important to diversify immediately. This can happen over time as you grow your portfolio. To start, you would need to save of $500 a month. It would be best if you could find these savings during the year and every January invest the lump sum. This would keep buying commissions low as there would only be one per year. The dividends when they get re-invested in more shares of the same company, will only be purchased in full shares. there is always a little cash left over that accumulates in