Dear shareholders of Dividend Café.

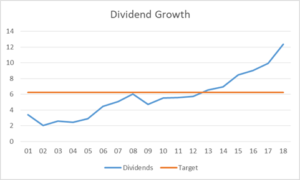

We are pleased to report that your portfolio had a record amount of dividend income. Never have we reached the cashflow amount of this last year. Our dividend increases over the same period the year before was 13.34 percent. We have averaged almost a 10 percent increase in dividends annually over the last 10 years. This is what the portfolio is designed for. Our performance is measured by the amount of dividend income.

Your portfolio manager has worked hard to make sure that the asset allocation and diversification of the holdings are where they should be. Not, there were no changes made to the portfolio and the only job for the manager was to direct the cash to various shareholder accounts. He is probably overpaid for the services provided. But then again, the fund does not pay any service charges.

This is what it is like managing your own investments once you have a plan and believe in it.

That is not to say that all was well in 2022. For investors that look at total return this has not been a good year. Nasdaq down 33%, Dow Jones 9%, TSX down 8.5%. All the major markets were down. But what matters most is, how did you do. As I said above, our plan worked well and we had a good year.

Since retiring 5 years ago we have used the following withdrawal strategy. I have a small work pension and my spouse a small CPP amount. Then we take the minimum amount required out of our RIFF’s, which is made up of dividends. There is no need to sell any shares. The rest of our income are dividends out of the TFSAs, and two nonregistered accounts. But when we do not need all these dividends, we have re-invested them.

With the TFSA accounts you can invest $6000 of new money each year and replace any money you withdrew the year before. So, we take an additional lump sum amount out of our RRIF’s at the beginning of the year to fund the TFSA’s and make them whole again. On the lump sum withdrawal there is tax withheld, 30%. We do this to pay more tax now and reduce the holdings in the RIFF accounts. We also dipped into our “Emergency Fund” aka line of credit, to buy a new car. Now paying it off with dividends. I have finally agreed to build a small real emergency fund and keep some money on hand. This has never been required but will try it.

A friend asked me recently why I write a blog, and what is it you want to reader to hear. I had to think for a moment but came up with this answer. I would like to say to the people that think investing is too complicated and turn away when the subject comes up. Learn to become your own advisor and do it yourself. You keep giving your money to an advisor that works in his interest, not yours. To which my friend replied, “no one cares about your money as much as you do.” Right, do a little reading, find a source you can trust, and do it yourself. It is not difficult. Read some of my other post to see how simple it can be.

I will say it again, for a Canadian investor that believes he/she cannot do it themselves, go to the BTSX system. This system is to buy the ten highest dividend payers on the TORONTO Stock Exchange in equal amounts. Then repeat on a yearly basis. The BTSX process and performance is described at http://dividendstrategy.ca/.

Every investor should have a plan and then stick to it. It is easy to listen to your friends or read in the media about the next great thing to invest in. But if it does not fit with your plan, it is better to avoid it. There is nothing wrong with chasing big returns if you have time and lots of money. But if it is your family’s retirement money, better to be a little more conservative. There are always people you read about that invested in Google, Tesla, Shopify, and others when they started and made a lot of money. But how often do you know what the next great company will be. Maybe put a portion of your portfolio aside for this but go with a proved method for the bulk of it.

Please leave a comment if you agree, disagree, or have a question.

Thanks for the comment Andrew. I also just buy and hold my dividend stocks. There is no need for re-balancing in my view if you hold a portfolio of these stocks. And we own others as well. I just think for novice investors the BTSX is the simplest and best option if the want to get in to equity investing. No need for ETFs or other approaches and pay fees. Once your comfortable you can branch out and explore. But don’t let people tell you how diversified you must be and confuse you into thinking investing is hard. Keep learning and make your own decisions.

Thanks for the question Ron. I have no problem sharing info on the stocks we hold. Our portfolio is built to produce income. Therefore the majority of our holdings are Canadian dividend payers. All the banks, Bell Canada, Telus, Fortis, Emera, Power Corp, Enbridge, TC Energy, Capital Power. Any one of these is a good addition for an income portfolio.