When I started out in 1995 to build a dividend portfolio, the first thing was to come up with a goal. We wanted to have a portfolio that would give us enough in dividends so that we didn’t have to dip into the capital. The reason I believe so strongly in this strategy is that when you buy shares in companies that have a long history of paying and increasing dividends, you can get paid in good as well as bad times in the market. The Canadian banks, for example, have paid dividends for over 100 years. So why sell them? They continue to increase their dividends annually, sometimes more often. And during the recession of 2008 when so many people got out of the market, the banks held their dividends steady.

As I have indicated, I want to present a different view. You may think it would take too long to save enough to not have to use the principal. But I believe you can both live off the dividends and if you have to later on, sell some shares if additional income is needed. Or leave it to your kids.

Not everyone is patient enough to use this strategy as it is a slow start before you see the compounding take effect. But if you stay with it and don’t panic when the media tells you that you need to change direction, you will see the rewards. You may miss some good tech companies or others that don’t pay dividends, but you may also avoid some mistakes.

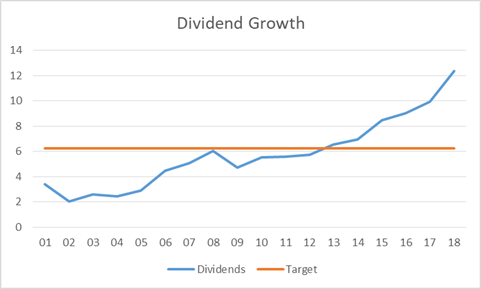

Here is a chart of how we grew our dividends from 2001 to 2018 compared to the target we had set.

We currently have shares in only one company that does not pay dividends. BRK.B (Berkshire Hathaway) Berkshire is the world’s 10th largest company by revenue. So this is like owning a US mutual fund without having to pay any fees.

Our total portfolio dividend yield is 3.91% based on today’s share prices. Or over 21% on amount invested.