Whenever you read or hear anything about investing, you get the same old advice. “You must have equities and fixed income. You must be diversified across sectors and countries, and you must be in emerging markets. The conventional wisdom is 60% equities and 40% fixed income.” Really?

First, it should depend on an individual’s circumstances. How much time do you have to be in the market? What assets do you have and what are you expecting to need to spend in retirement or other things you are investing for. It also needs to take into consideration what your risk tolerance is, and how much time do you want to spend on this.

For our dividend strategy we had a long-time horizon and wanted to create an income stream of dividends to pay all expenses in retirement. When you look at the Canadian market for dividend paying equities, the banks are probably the most reliable. They have paid dividends for over 100 years and usually raise them once or twice a year. Then there are the utilities that provide electricity and gas to our homes and pay regular and rising dividends. We also have a very concentrated telecom sector, that is also exceptionally reliable as dividends payers.

When it comes to diversification look at the banks, they do business with every sector in the country as well as other countries around the world. This also is diversification. Some of the utilities also have operations in other countries. Reits and pipelines are other areas that seem to hold up well in most economic times. I believe you are better of choosing companies like these then spreading your investments over all sectors and dilute your gains. We are staying away from the resource sector as this is too volatile. With this strategy we will miss opportunities like tech stocks but have some exposure through a Nasdaq ETF.

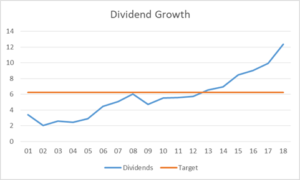

We have a documented history of dividend investing now for 20 years and average annual returns of 11%. We don’t need to re-balance the portfolio very much as it consists of only equities that we believe will get us to our goal. We did have a couple of companies that did become a little to high a percentage in the over portfolio, so we did trim it down and bought more banks.

The measurement for us is dividend growth. In the last 10 years we have average annual dividend growth of 8.5%. Now that we are using the dividends as our income this is the most important aspect. Dividends increases are the inflation protection you do not get with fixed income. Also, with GIC and bond yields below inflation rates, why is this still touted as a must have in every balanced portfolio. Your loosing money. Our fixed income are the utilities, they do not increase in value as much as other equities but pay consistent and rising dividends.

There are many ways to invest and all kinds of extraordinarily successful investors. The most important point is that you make a plan based on your level of competence and comfort and execute that plan.